UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )2)

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant ☐ | |

Check the appropriate box: | |

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Diffusion Pharmaceuticals Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check | ||

☒ | No fee required. | |

|

| |

☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and | |

PRELIMINARY COPY PROXY MATERIALS

SUBJECT TO COMPLETION, DATED MARCH 18,DECEMBER 1, 2022

In accordance with Rule 14a-6(d) under Regulation 14A, please be advised that the Diffusion Pharmaceuticals Inc. intends to release definitive copies of this Proxy Statement on or about March 28, 2022.

Diffusion Pharmaceuticals Inc.

300 East Main Street, Suite 201

Charlottesville, Virginia 22902

March [•],[ ], 2022

Dear Fellow Stockholders:

We are pleased to invite you to join us for a Specialthe Diffusion Pharmaceuticals Inc. 2022 Annual Meeting of Stockholders of Diffusion Pharmaceuticals Inc. to be held on Thursday, April 14,Friday, December 30, 2022, at 9:00[ ] a.m., Eastern Time. The meetingAnnual Meeting will be conducted virtually andas a virtual meeting hosted by means of a live webcast. YouRegistered stockholders as of the record date or your proxyholdertheir proxyholders will be able to attend the meetingAnnual Meeting online, vote, and submit questions by following the instructions provided in the accompanying noticeNotice Regarding the Availability of meetingProxy Materials and proxy statement.

Your vote is particularly important at the Annual Meeting. As you may be aware, LifeSci Special Opportunities Master Fund Ltd. (“LifeSci”) has notified the Company that it intends to nominate a slate of six nominees to stand for election as directors at the Annual Meeting in opposition to the nominees recommended by our Board of Directors. You may receive a proxy statement, blue proxy card and other solicitation materials from LifeSci; however, since LifeSci has the option to choose which of our stockholders will receive their proxy solicitation materials, we cannot be certain whether you will receive them. The Company is not responsible for the accuracy of any information provided by, or relating to, LifeSci or its nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, LifeSci, or any other statements that LifeSci may otherwise make.

Our Board of Directors does NOT endorse any of LifeSci’s nominees and unanimously recommends that you vote “FOR” each of the six nominees proposed by our Board of Directors on your enclosed WHITE proxy card. The Diffusion Board of Directors strongly urges you NOT to sign or return any blue proxy card sent to you by LifeSci. If you have previously submitted a blue proxy card sent to you by LifeSci, you can revoke that proxy and vote for our Board of Directors’ nominees and on the other matters to be voted on at the Annual Meeting at any time before it is exercised by signing, dating and mailing the enclosed WHITE proxy card in the envelope provided. Only your latest dated proxy will be counted. Even if you would like to elect some or all of LifeSci’s nominees, we strongly recommend you use the Company’s WHITE proxy card to do so.

We strongly encourage you to read the accompanying proxy statement carefully and to use the enclosed WHITE proxy card to vote for the Board of Directors’ nominees, and in accordance with the Board of Directors’ recommendations on the other proposals, as soon as possible. It is important that your shares be represented at the meeting, regardless of the number of shares you hold. Accordingly, please exercise your right to vote by completing, signing, dating, and returning your proxy card, by using Internet or telephone voting as described in the accompanying proxy statement, or by voting at the meeting by following the instructions in the accompanying proxy statement.

On behalf of the Board of Directors and management of Diffusion Pharmaceuticals Inc., it is my pleasure to express our appreciation for your support. If you have any questions, please contact Innisfree M&A Incorporated, Inc., our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders in the U.S. and Canada may call toll-free at (877) 456-3402. Banks and brokers may call collect at (212) 750-5833.

Sincerely,

/s/ Robert J. Cobuzzi, Jr.

Robert J. Cobuzzi, Jr.

President and Chief Executive Officer

THE ACCOMPANYING PROXY STATEMENT AND PROXY CARD ARE FIRST BEING MAILED TO STOCKHOLDRES ON OR ABOUT MARCH [•], 2022.Your vote is important. Please exercise your right to vote as soon as possible by completing, signing, dating, and returning your enclosed proxy card by mail in the postage-paid envelope provided, by using Internet or telephone voting as described in your enclosed proxy card, or by following the other instructions for voting on your enclosed proxy card.

PRELIMINARY COPY SUBJECT TO COMPLETION DATED MARCH 18, 2022

In accordance with Rule 14a-6(d) under Regulation 14A, please be advised that the Diffusion Pharmaceuticals Inc. intends to release definitive copies of this Proxy Statement on or about March 28, 2022.

NOTICE OF SPECIAL2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, APRIL 14,FRIDAY, DECEMBER 30, 2022

To the Stockholders of Diffusion Pharmaceuticals Inc.:

A SpecialThe 2022 Annual Meeting of Stockholders of Diffusion Pharmaceuticals Inc., a Delaware corporation (“Diffusion” or the “Company”), will be held virtually on Thursday, April 14,Friday, December 30, 2022 at 9:00[ ] a.m. Eastern Time by means of a live webcast for the following purposes:

1. | To |

2. | To ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022; |

3. | To approve, on an advisory basis, the compensation of our named executive officers during the year ended December 31, 2021, as disclosed in the accompanying proxy statement; and |

4. | To transact such other business as may properly come before the meeting or any adjournment or postponement of the |

The meetingRegistered stockholders as of the record date and their proxyholders will be completely virtual and there will be no physical location for stockholdersable to attend. In order to attendsubmit questions in advance of the meeting, youlisten to the meeting live, and vote online. To access and participate in the virtual meeting, registered stockholders and beneficial stockholders (those holding shares through a stock brokerage account or by a bank or other holder of record) will need to pre-register by [ ] a.m. Eastern Time on December [ ], 2022. To pre-register for the meeting, please follow these instructions:

Registered Stockholders

Stockholders of record as of the record date may register to participate in the Annual Meeting remotely by visiting the website [ ]. Please have your proxy card, or Notice, containing your control number available and follow the instructions to complete your registration request. After registering, stockholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. Requests to register to participate in the Annual Meeting remotely must pre-register at [•be received no later than [ ] a.m., Eastern Time, on December [ ], 2022.

Beneficial Stockholders

Stockholders whose shares are held through a broker, bank or other nominee as of the record date may register to participate in the Annual Meeting remotely by 11:59 p.m. ETvisiting the website [ ].

Please have your Voting Instruction Form, Notice, or other communication containing your control number available and follow the instructions to complete your registration request. After registering, stockholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. Requests to register to participate in the Annual Meeting remotely must be received no later than [ ] a.m., Eastern Time, on April [•],December [ ], 2022. If you holdare a beneficial stockholder and you wish to vote your shares in “street name” through aonline during the virtual Annual Meeting, rather than submitting your voting instructions before the Annual Meeting, you will need to contact your bank, broker or other nominee and also wish to vote at the meeting,obtain a legal proxy form that you will need to obtain from that entitysubmit electronically with your ballot during the online virtual Annual Meeting using a “legal proxy” and submit it when you register. After you register, you will receive an email with a unique link and password that will allow youPDF, JPG, JPEG, GIF or PNG file format.

Questions on How to attend the meeting. If your shares are held in “street name” and you provided a legal proxy when you registered, that email will also contain a control number that will allow you to vote at the meeting. Pre-register

If you hold your shares through our transfer agent, usehave any questions or require any assistance with pre-registering, please contact the control number on yourCompany’s proxy card to vote at the meeting.solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders may call toll free: (877) 456-3402

Banks and Brokers may call collect: (212) 750-5833

The meeting webcast will begin promptly at 9:00[ ] a.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online check-inAs the Annual Meeting will begin at 8:45 a.m. Eastern Time, and you should allow ample time for the check-in procedures. If you experience technical difficulties during the check-in process or during the meeting, please call the number on thebe a completely virtual meeting, portal landing pagethere will be no physical location for assistance. For additional information on how you can attend and participate in the meeting, please see the instructions beginning on page 1 of the proxy statement that follows.stockholders to attend.

Only stockholders of record at the close of business on March [•],[ ], 2022 will be entitled to notice of, and to vote at, the meeting and any adjournments or postponements thereof. A stockholder list will be available electronically upon request tobeginning December 20, 2022, the Company beginningdate which is ten days prior to the date of the meeting, during normal business hours for examination by any stockholder registered on Diffusion’s stock ledger as of the record date for any purpose germane to the meeting.

We have received notice from LifeSci Special Opportunities Master Fund Ltd.(“LifeSci”) that it intends to nominate a slate of six nominees to stand for election as directors at the Annual Meeting in opposition to the nominees recommended by our Board of Directors. Our Board of Directors does not endorse the election of any of the LifeSci nominees for director and recommend that you vote “FOR” each of the Company’s six director nominees. You may receive proxy solicitation materials from LifeSci or other persons or entities affiliated with LifeSci, including an opposition proxy statement or blue proxy card. Our Board of Directors urges you to disregard such materials. We are not responsible for the accuracy of any information provided by or relating to LifeSci or its nominees contained in solicitation materials filed or disseminated by or on behalf of LifeSci or any other statements LifeSci may otherwise make. LifeSci chooses which of the Company’s stockholders will receive its proxy solicitation materials. Therefore, you may or may not receive those materials depending on what LifeSci decides.

Even if you have previously signed a blue proxy card sent to you by or on behalf of LifeSci, you have the right to change your vote by following the instructions on the enclosed WHITE proxy card to vote via the Internet or by telephone or by completing, signing, dating and returning the enclosed WHITE proxy card by mail in the postage-paid envelope provided. Only the latest-dated, properly executed proxy you submit will be counted. We urge you to disregard any blue proxy card sent by or on behalf of LifeSci or any person other than the Company. Voting to “WITHHOLD” your vote with respect to the nominees on any blue proxy card that is circulated by or on behalf of LifeSci is not the same as voting for our director nominees, because a vote to “WITHHOLD” with respect to any of the nominees on a blue proxy card will revoke any previous proxy submitted by you on the WHITE proxy card. Your vote is very important.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE COMPANY’S SIX DIRECTOR NOMINEES NAMED ON THE ENCLOSED WHITE PROXY CARD, AND URGES YOU NOT TO SIGN OR RETURN ANY blue PROXY CARD SENT TO YOU BY OR ON BEHALF OF LIFESCI.

If your shares are held in street name through a broker, bank or other nominee, you are considered the beneficial owner of those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares. Without your voting instructions, because of the contested nature of the proposals, to the extent your broker, bank or other nominee provides you with LifeSci’s proxy materials, your broker, bank or other nominee may not vote your shares with respect to the election of the Board of Directors’ nominees (Proposal 1) or on any of the other proposals on the agenda for the Annual Meeting. Even if your broker, bank or other nominee does not provide you with LifeSci’s proxy materials, without your voting instructions, your broker, bank or other nominee may only vote your shares on proposals considered to be routine matters. For non-routine matters, your shares will not be voted without your specific voting instructions. To the extent you receive proxy materials from LifeSci, none of the proposals to be voted on at the Annual Meeting will be considered “routine” and therefore, if you do not instruct your broker as to how to vote your shares, your shares will not be voted and will result in “broker non-votes”. We encourage you to instruct your broker, bank or other nominee to vote your shares by following the instructions on the enclosed WHITE proxy card to vote by telephone or internet, or by completing, dating, signing and mailing the enclosed WHITE proxy card in the postage-paid envelope provided.

If you have any questions regarding this information or the proxy materials, please contact Innisfree M&A Incorporated,Inc., our proxy solicitor. Stockholders in the U.S. and Canada may call toll-free at (877) 456-3402. Banks and brokers may call collect at (212) 750-5833.

Whether you plan to be present at the Annual Meeting or not, you are requested to promptly submit your proxy either electronically via the Internet or by telephone as described on the enclosed WHITE proxy card or by completing, signing and returning the proxy card by mail to ensure that your shares will be represented.

Important Notice Regarding the Availability of Proxy Materials for the |

By Order of the Board of Directors, | |||

| /s/ William | |||

| William | |||

| General Counsel & Corporate Secretary | |||

| [ ], 2022 | |||

| Charlottesville, Virginia | |||

March [•], 2022Charlottesville, Virginia

TABLE OF CONTENTS

As used

INTRODUCTORY NOTES

Note Regarding Company References and Other Defined Terms

Unless the context otherwise requires, in this proxy statement,the accompanying Proxy Statement and related materials, (i) references to “Diffusion,”the “Company,“Company,”“we, “we,”“us, “our,”“our” and similar references or “us” refer to Diffusion Pharmaceuticals Inc. and our consolidated subsidiaries, (ii) the term “common stock” refersreferences to our“common stock” refer to the common stock, par value $0.001 per share, of the Company. We have also used several other defined terms in the accompanying Proxy Statement and (iii)related materials, which are explained or defined below:

Term | Definition |

2015 Equity Plan | Diffusion Pharmaceuticals Inc. 2015 Equity Incentive Plan, as amended |

401(k) Plan | Diffusion Pharmaceuticals Inc. 401(k) Defined Contribution Plan |

Annual Meeting | 2022 Annual Meeting of Stockholders of Diffusion Pharmaceuticals Inc. to be held virtually at [ ] a.m. Eastern Time, on Friday, December 30, 2022 |

Annual Report | the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 |

Black-Scholes Model | Black-Scholes-Merton derivative investment instrument pricing model |

Board | our board of directors |

Bylaws | the Company's bylaws, as amended |

Computershare | Computershare Inc., our transfer agent and registrar |

Diffusion LLC | Diffusion Pharmaceuticals LLC, a Virginia limited liability company and our wholly owned subsidiary |

Exchange Act | Securities Exchange Act of 1934, as amended |

Innisfree | Innisfree M&A Incorporated |

KPMG | KPMG LLP, our independent registered public accounting firm for the fiscal year ending December 31, 2022 |

LifeSci | LifeSci Special Opportunities Master Fund Ltd. |

Nasdaq | Nasdaq Stock Market, LLC |

NQO | non-qualified option |

NYSE | New York Stock Exchange |

Proxy Statement | this proxy statement on Schedule 14A for our 2022 Annual Meeting of Stockholders |

Radford | Radford, Data & Analytics, a partial business unit of Aon plc, independent consultant to the Compensation Committee of the Board |

Record Date | , 2022 |

Regulation S-K | Regulation S-K promulgated under the Securities Act |

SEC | U.S. Securities and Exchange Commission |

Securities Act | Securities Act of 1933, as amended |

Tax Code | U.S. Internal Revenue Code of 1986, as amended |

U.S. | United States |

Note Regarding Stock Splits

Unless the term “Series C Preferred Stock” referscontext otherwise requires, in this Proxy Statement, all share and per share amounts related to our Series C convertible, preferredcommon stock par value $0.001 per share.give effect to our 1-for-50 reverse stock split effective April 18, 2022.

Note Regarding Trademarks, Trade Names, and Service Marks

This Proxy Statement contains certain trademarks, trade names, and service marks of ours, including “DIFFUSIO2N.” All other trade names, trademarks, and service marks appearing in this Proxy Statement are, to the knowledge of Diffusion, the property of their respective owners. To the extent any such terms appear without the trade name, trademark, or service mark notice, such presentation is for convenience only and should not be construed as being used in a descriptive or generic sense.

300 East Main Street, Suite 201Charlottesville, Virginia 22902

PROXY STATEMENT FOR SPECIALANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY APRIL 14,FRIDAY DECEMBER 30, 2022

The board of directors (the “Board”) of Diffusion Pharmaceuticals Inc. (the “Company”) is using this proxy statement (this “Proxy Statement”) to solicit your proxy for use at a Specialthe Diffusion Pharmaceuticals Inc. 2022 Annual Meeting of Stockholders (the “Special Meeting”) to be held virtually at 9:00[ ] a.m., Eastern Time, on Thursday, April 14,Friday, December 30, 2022. The Board expects to mailmake available electronically or to send to our stockholders the Notice of Annual Meeting of Stockholders, this Proxy Statement and a form of proxy on or about March [•],[ ], 2022.

GENERAL INFORMATION ABOUT THE SPECIALANNUAL MEETING AND VOTING

Why am I receiving these materials?

We have sent you this Proxy Statement and the enclosedWHITE proxy card because the Board is soliciting your proxy to vote at the SpecialAnnual Meeting. The SpecialAnnual Meeting will be conducted online only. You are invited to virtually attend the SpecialAnnual Meeting to vote on the proposals described in this Proxy Statement by following instructions included herein.in this Proxy Statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed WHITEproxy card by mail in the postage-paid envelope provided, or follow the instructions below on the closed WHITE proxy card to submit your proxy over the telephone or on the Internet.

I previously received materials for a special meeting of the Company’s stockholders to be held on April 14, 2022 dated February 28, 2022. Are these materials different?

Yes. As described in more detail herein, on March 18, 2022, we filed a current report on Form 8-K with the U.S. Securities and Exchange Commission (“SEC”) announcing our cancellation of the special meeting of stockholders previously scheduled for April 14, 2022 (the “Old Special Meeting”), the termination of the Prior Solicitation (as defined herein), the approval of the Bylaw Amendment (as defined herein), and the anticipated closing of the Series C Issuance (as defined herein).

This Proxy Statement relates the new Special Meeting, which was called for the same date and time (i.e., April 14, 2022 at 9:00 a.m. Eastern Time) subsequent to the consummation of the transactions described above.

I already voted my shares after I received materials related to the Old Special Meeting. Do I need to vote again?

Yes. Votes cast and proxies granted in connection with the Old Special Meeting will not count at the new Special Meeting. Holders who voted their shares in connection with the Old Special Meeting must re-cast their or re-grant their proxy pursuant to the instructions included herein to be counted or be effective at the new Special Meeting.

When and where will the SpecialAnnual Meeting be held?

The SpecialAnnual Meeting will be held online via live webcast on Thursday, April 14,Friday, December 30, 2022, at 9:00[ ] a.m., Eastern Time.

The SpecialHow do I attend the Annual Meeting?

Attendance at the Annual Meeting or any adjournment or postponement thereof will be limited to stockholders of the Company as of the close of business on the record date and guests of the Company. You will not be able to attend the Annual Meeting in person at a completelyphysical location. In order to attend the virtual meeting, you will need to pre-register by [●]:00 a.m. Eastern Time on [●], 2022. To pre-register for the meeting, please follow these instructions:

Registered Stockholders

Stockholders of stockholders conducted exclusively by live webcast to enable our stockholdersrecord as of the record date may register to participate from any location aroundin the world that is convenientAnnual Meeting remotely by visiting the website [ ]. Please have your proxy card, or Notice, containing your control number available and follow the instructions to them. No physical meetingcomplete your registration request. After registering, stockholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. Requests to register to participate in the Annual Meeting remotely must be held.received no later than [●] a.m., Eastern Time, on [●], 2022.

WeBeneficial Stockholders

Stockholders whose shares are held through a broker, bank or other nominee as of the record date may register to participate in the Annual Meeting remotely by visiting the website [ ].

Please have createdyour Voting Instruction Form, Notice, or other communication containing your control number available and implementedfollow the instructions to complete your registration request. After registering, stockholders will receive a confirmation email with a link and instructions for accessing the virtual formatAnnual Meeting. Requests to facilitate stockholder attendance and participation by enabling stockholdersregister to participate fully,in the Annual Meeting remotely must be received no later than [●] a.m., Eastern Time, on [●], 2022. If you are a beneficial stockholder and equally, from any location aroundyou wish to vote your shares online during the world, at no cost. A virtual SpecialAnnual Meeting, makes it possible for more stockholders (regardless of size, resources,rather than submitting your voting instructions before the Annual Meeting, you will need to contact your bank, broker or physical location)other nominee to have direct accessobtain a legal proxy form that you will need to information more quickly, while saving the company and our stockholders time and money, especially as physical attendance at meetings has dwindled. We also believe thatsubmit electronically with your ballot during the online tools wevirtual Annual Meeting using a PDF, JPG, JPEG, GIF or PNG file format.

Questions on How to Pre-Register

If you have selected will increase stockholder communication. However, you will bear any costs associatedquestions or require any assistance with your Internet access, such as usage charges from Internet access providerspre-registering, please contact the Company’s proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders may call toll free: (877) 456-3402

Banks and telephone companies.Brokers may call collect: (212) 750-5833

The online meeting will begin promptly at 9:00[ ] a.m. Eastern Time on April 14,December 30, 2022. We encourage you to access the meeting approximately 15[ ] minutes prior to the start time in order to leave ample time for the check in.time. Please follow the registration instructions as outlined in this proxy statement.Proxy Statement.

How do I attend the Special Meeting? Do I needhave the option to registercall in advance in order to attend the Special Meeting?Annual Meeting instead of attending the live webcast?

BothNo. Stockholders will not have the option to call in to the virtual meeting and listen by telephone. To participate in the Annual Meeting, stockholders of record and street name stockholders will be able to attendmust stream the SpecialAnnual Meeting live via live audio webcast and vote their shares electronically at the Special Meeting. However, you will need to register in advance in accordance with the instructions below in order to attend.webcast.

In order to attend the meeting, you must pre-register at [•] by 11:59 p.m. ET on April [•], 2022. If you hold your shares in “street name” through a bank, broker or other nominee, and also wish to vote at the meeting, you will need to obtain from that entity a “legal proxy” and submit it when you register. After you register, you will receive an email with a unique link and password that will allow you to attend the meeting. If your shares are held in “street name” and you provided a legal proxy when you registered, that email will also contain a control number that will allow you to vote at the meeting. If you hold your shares through our transfer agent, use the control number on your proxy card to vote at the meeting. You will not need the Virtual Control Number to join the meeting, you will need it if you choose to vote during the meeting.

How do I submit questions for the SpecialAnnual Meeting?

You can submit questions pertinent to meeting matters at the virtual SpecialAnnual Meeting only if you are a stockholder of record of the Company at the close of business on the Record Date and you registered in advance to attend the Annual Meeting, or if you were a beneficial owner as of the Record Date and you registered in advance to attend the SpecialAnnual Meeting.

During The question and answer session will answer questions submitted live during the Special Meeting, we are committed to acknowledging each appropriate question in the order in which it was received. StockholdersAnnual Meeting. Questions may also submit questions prior to the date of the Special Meeting by e-mailing them to proxyrequests@diffusionpharma.com. When submitting questions, stockholders should identify themselves and provide contact information in the event follow up is necessary. Each stockholder who submits a question will be identified before his or her question is answered. Any questions relevant to the business of the Special Meeting that cannot be answered due to time constraints can be submitted to Diffusion Investor Relations by e-mailing info@diffusionpharma.com. Stockholders participating in the virtual meeting will be in a listen-only mode and will not be able to speak during the webcast.Annual Meeting on the Annual Meeting website using the ‘Ask a Question’ box.

In accordance with the rules of order, a copy of which will be available during the SpecialAnnual Meeting, only questions pertinent to meeting matters will be answered. In the interest of fairness to all stockholders, the question and answer period will be limited to a total of twenty[ ] minutes and multiple questions submitted on the same topic will be summarized and responded to collectively. The Company reserves the right to not address any questions that are repetitious, irrelevant to the Company’s business, related to pending or threatened litigation, derogatory in nature, related to personal grievances, or otherwise inappropriate.

During the Annual Meeting, we are committed to acknowledging each appropriate question in the order in which it was received. When submitting questions, stockholders should identify themselves and provide contact information in the event follow up is necessary. Any questions relevant to the business of the Annual Meeting that cannot be answered due to time constraints can be submitted to Diffusion Investor Relations by e-mailing info@diffusionpharma.com.

Whom do I contact if I am encountering difficulties attending the SpecialAnnual Meeting online?

There will be technicians readyThe virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to assistparticipate in the Annual Meeting. We encourage you with any technical difficulties you may have accessingto access the SpecialAnnual Meeting live audio webcast. Please be sure to check in by 8:45 a.m. ET on April 14, 2022, (i.e., 15 minutes prior to the start oftime. A link on the meeting is recommended) so that any technical difficultiespage will provide further assistance should you need it or you may be addressedcall the support number found in the reminder email you will receive the day before the Special Meeting live audio webcast begins. If you encounter any difficulties accessing the webcast during the check-in or meeting time, please email [•] or call [•].Annual Meeting.

What is the purpose of the SpecialAnnual Meeting?

The purpose of the SpecialAnnual Meeting is to vote on the following proposals:

1. | To |

2. | To ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2022; |

3. | To approve, on an advisory basis, the compensation of our named executive officers during the year ended December 31, 2021, as disclosed in the Proxy Statement; and |

4. | To transact such other business as may properly come before the meeting or any adjournment or postponement of the |

Who is entitled to vote at the Annual Meeting?

Stockholders of record at the close of business on [ ], 2022, the Record Date, will be entitled to notice of and to vote at the meeting or any adjournment or postponement of the Annual Meeting. As of the Record Date, there were [______] shares of our common stock outstanding. Each share of our common stock is entitled to one vote on each matter to be voted on at the Annual Meeting.

How do I vote my shares?

Your vote is important. Whether you hold shares directly as a stockholder of record or beneficially in “street name” (through a broker, bank, or other nominee), you may vote your shares without attending the Annual Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee.

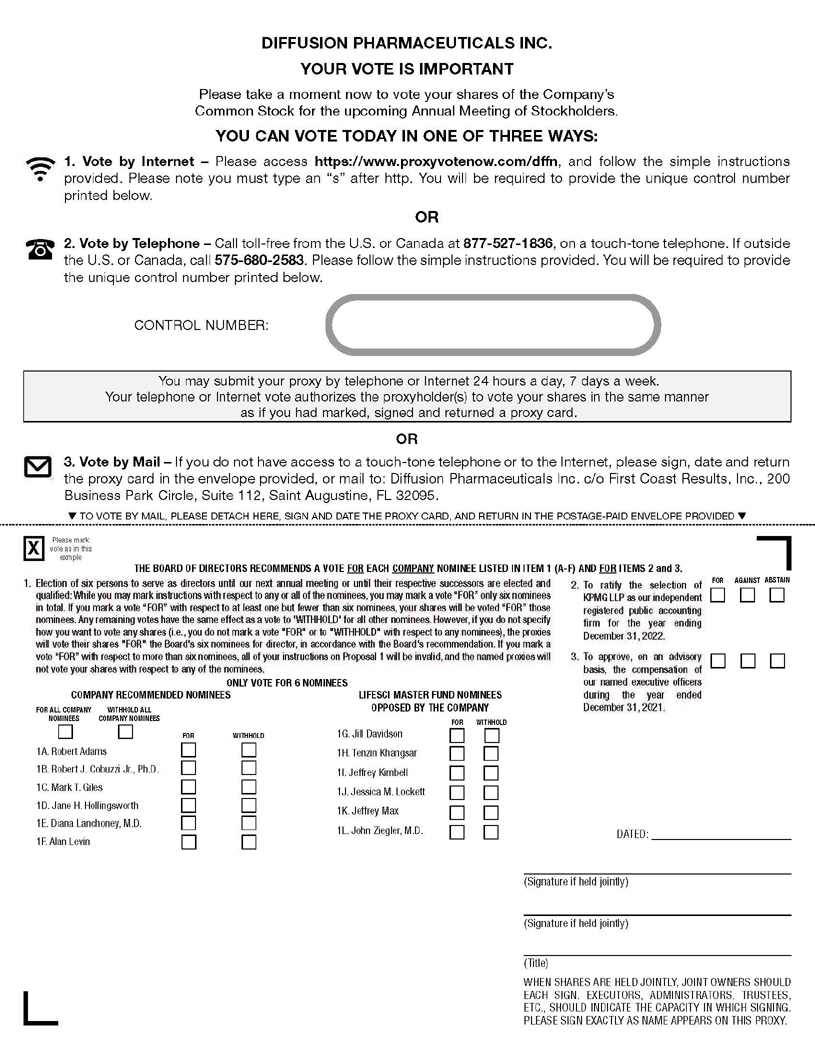

If you are a stockholder whose shares are registered in your name, the Board encourages you to follow the instructions on your WHITE proxy card to vote your shares by one of the following methods:

● | Virtually During the Meeting, by pre-registering to attend the Annual Meeting, joining the Annual Meeting and voting your shares electronically during the Annual Meeting by clicking on the “Shareholder Ballot” link on the virtual meeting site. |

● | Vote by Internet, by going to the web address indicated on the enclosed WHITE proxy card and following the instructions listed thereon. |

● | Vote by Telephone, by dialing the toll-free number listed on the enclosed WHITE proxy card and following the instructions. |

● | Vote by Mail, by completing, signing, dating, and mailing the enclosed WHITE proxy card in the postage-paid envelope provided. If you vote by Internet or telephone, please do not mail your proxy card. |

If your shares are held in “street name” through a brokerage firm, bank, dealer or similar organization, as the beneficial owner of those shares you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting via the Internet. However, because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid legal proxy from your broker or other agent. Please follow the instructions from your broker, bank or other agent included on the WHITE Voting Instruction Form accompanying these proxy materials, or contact your broker, bank or other agent to request a legal proxy. If you hold your shares in “street name,” please instruct your bank, broker, trust or other nominee how to vote your shares using the WHITE Voting Instruction Form provided by your bank, broker, trust or other nominee so that your vote can be counted. The WHITE Voting Instruction Form provided by your bank, broker or other nominee may also include information about how to submit your voting instructions over the Internet or by telephone, if such options are available.

The deadline for voting by telephone or by using the Internet is 11:59 p.m. Eastern Time on [ ], December [__], 2022. Please see your proxy card or the information your bank, broker or other holder of record provided to you for more information on your options for voting.

Has Diffusion been notified that a stockholder intends to propose alternative director nominees at the Annual Meeting?

Yes. LifeSci has announced that it intends to nominate a slate of six nominees for election to the Board of Directors at the Annual Meeting in opposition to the nominees recommended by the Board of Directors. The Board does NOT endorse any LifeSci nominee and unanimously recommends that you vote “FOR” the election of each of the six nominees recommended by the Board. Each of Diffusion and LifeSci will use its own version of a universal proxy card containing the names of both Diffusion’s and LifeSci’s nominees. The Board urges you to vote “FOR” the election of each of the six nominees recommended by the Board using our enclosed universal WHITE proxy card and NOT to sign or return or vote using any universal blue proxy card sent to you by LifeSci. However, if you have already voted “FOR” the election of each of the six nominees recommended by the Board using a blue proxy card sent to you by LifeSci, you do not need to vote on the enclosed universal WHITE proxy card.If you sent in a blue proxy card and wish to change your vote, you can revoke the blue proxy card at any time before it is exercised by voting using the enclosed WHITE proxy card.

What does it mean if I receive more than one proxy card?

Many of our stockholders hold their shares in more than one account and may receive separate proxy cards or voting instruction forms for each of those accounts. If you receive more than one WHITE proxy card, your shares are registered in more than one name or are registered in different accounts. Please sign, date and return or otherwise submit your proxy with respect to each WHITE proxy card to ensure that all of your shares are voted.

Additionally, LifeSci has stated its intention to nominate six individuals for election as directors at the Annual Meeting. If LifeSci proceeds with its nominations, you may receive proxy solicitation materials from LifeSci, including an opposition proxy statement and a blue proxy card. Because LifeSci may choose to send its proxy solicitation materials to only a portion of our stockholders, you may or may not receive those materials depending on what LifeSci decides.

In the event you do receive materials from LifeSci, the Board of Directors unanimously recommends that you disregard and do NOT return any blue proxy card you receive from LifeSci.

Voting to “WITHHOLD” with respect to any LifeSci nominee on a blue proxy card sent to you by LifeSci is NOT the same as voting for the Board of Directors’ nominees because a vote to “WITHHOLD” with respect to any LifeSci nominee on its blue proxy card will revoke any proxy you previously submitted. For example, this means that if you have submitted a validly executed proxy voting FOR the nominees recommended by the Board but later submit a validly executed proxy withholding your votes from the LifeSci nominees, your prior vote in favor of the nominees recommended by the Board will not be counted.

If you have already voted using LifeSci’s blue proxy card, you have every right to change your vote and revoke your prior proxy before it is exercised by signing and dating the enclosed WHITE proxy card and returning it by mail in the postage-paid envelope provided, by voting via the Internet, or by telephone by following the instructions provided on the enclosed WHITE proxy card. Only the latest dated proxy you submit will be counted. If you have any question or need assistance voting, please call Innisfree M&A Incorporated, Inc., Diffusion’s proxy solicitor. Stockholders in the U.S. and Canada may call toll-free at (877) 456-3402. Banks and brokers may call collect at (212) 750-5833.

How will my shares be voted?

The Board encourages stockholders to fill out and return your signed WHITE proxy card enclosed with this proxy statement or use Internet or telephone voting as instructed on your WHITE proxy card before the Annual Meeting. The named proxies will vote your shares as you direct.

For Proposal No. 1—Election of Directors, you may:

● | Vote FOR up to six of the nominees for director; or |

● | WITHHOLD your vote from up to six nominees for director. |

If you vote for more than six nominees for director, your vote on Proposal No. 1 will be invalid and will not be counted. To the extent a registered stockholder votes “FOR” with respect to at least one but fewer than six nominees on Proposal No. 1, his or her shares will only be voted “FOR” those nominees he or she has marked. Any remaining votes on Proposal No. 1 shall not be voted and will have the same effect as a vote to “WITHHOLD” for all other nominees. However, if he or she does not specify how to vote any shares (i.e., he or she does not mark a vote “FOR” or to “WITHOLD” with respect to any nominees), the proxies will vote their shares “FOR” the Board’s six nominees for director, in accordance with the Board’s recommendations.

For Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm and Proposal No. 3 – Advisory Vote on Executive Compensation you may:

● | Vote FOR the proposal; |

● | Vote AGAINST the proposal; or |

● | ABSTAIN from voting on the proposal. |

How does the Board recommend that I vote?

The Board recommends that you use the enclosed WHITE proxy card to vote as follows:

● | FOR the six nominees for director recommended by the Board in this proxy statement under Proposal No. 1—Election of Directors; |

● | FOR Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm; and |

● | FOR Proposal No. 3— Advisory Vote on Executive Compensation. |

THE BOARD URGES YOU NOT TO SIGN, RETURN OR VOTE ANY BLUE PROXY CARD THAT MAY BE SENT TO YOU BY LIFESCI EVEN AS A PROTEST VOTE, AS ONLY YOUR LATEST DATED PROXY CARD WILL BE COUNTED. IF YOU HAVE PREVIOUSLY SUBMITTED A VOTE USING THE BLUE PROXY CARD SENT TO YOU BY LIFESCI, YOU CAN REVOKE IT BY USING THE ENCLOSED WHITE PROXY CARD TO VOTE “FOR” OUR BOARD’S NOMINEES AND “FOR” ALL OTHER PROPOSALS RECOMMENDED BY OUR BOARD.

How can I revoke or change my vote?

If you are a stockholder whose shares are registered in your name, you may revoke your proxy at any time before it is exercised by one of the following methods:

● | Submitting another proper proxy with a more recent date than that of the proxy first given by following the Internet or telephone voting instructions or completing, signing, dating and returning a proxy card by mail; |

● | Sending timely written notice of revocation to our General Counsel & Corporate Secretary; or |

● | Attending the Annual Meeting and voting virtually. |

If you hold your shares through a broker, bank or other nominee, you may revoke your proxy by following instructions your broker, bank or other nominee provides.

If you have previously signed a blue proxy card sent to you by LifeSci, you may change your vote and revoke your prior proxy by signing and dating the WHITE proxy card enclosed with this proxy statement and returning it by mail in the postage-paid envelope provided or by voting via the Internet or by telephone following the instructions on the enclosed WHITE proxy card. Submitting a blue proxy card—even if you vote to “WITHHOLD” with respect to the LifeSci Nominees—will revoke any votes you previously made via our WHITE proxy card. Accordingly, if you wish to vote pursuant to the recommendation of our Board, you should disregard and NOT return any blue proxy card that you may receive from LifeSci, even as a protest vote against LifeSci.

Is the Company using a universal proxy card in connection with voting at the Annual Meeting?

Yes. The SEC has adopted new rules requiring the use of a universal proxy card in contested director elections that took effect on August 31, 2022 (the “New Proxy Rules”). As the Annual Meeting will be held on December 30, 2022, the New Proxy Rules are applicable to the 2022 Annual Meeting. Each of Diffusion and LifeSci will use its own version of a universal proxy card containing the names of both Diffusion’s and LifeSci’s nominees. Diffusion is using the enclosed WHITE universal proxy card. Our Board unanimously recommends using the enclosed WHITE universal proxy card and voting “FOR” all of the nominees proposed by the Board and disregarding any blue proxy card that may be sent to you by LifeSci.

What happens if I return a WHITE proxy card but give voting instructions for more than six candidates?

An “overvote” occurs when a stockholder submits more votes for director nominees than there are Board of Director seats up for election.

To the extent an overvote (i.e., voting “FOR” with respect to more than six nominees on Proposal 1) occurs on a record holder’s WHITE proxy card, all such votes on Proposal 1 regarding nominees will be invalid and will not be counted.

What happens if I return a WHITE proxy card but give voting instructions for less than six candidates?

An undervote occurs when a stockholder submits less votes “FOR” director nominees than there are Board of Director seats up for election.

To the extent a registered stockholder votes “FOR” or to “WITHHOLD” with respect to at least one but fewer than six nominees on Proposal No. 1, his or her shares will only be voted “FOR” those nominees he or she has marked. Any remaining votes on Proposal No. 1 will not be voted and will have the same effect as a vote to “WITHHOLD” for all other nominees.

However, if you are a registered stockholder and you send in your WHITE proxy card or use Internet or telephone voting as instructed on your WHITE proxy card, but do not specify how you want to vote any of your shares (i.e., you do not vote “FOR” or to “WITHOLD” with respect to any nominees), the proxies will vote their shares “FOR” the Board’s six nominees for director, in accordance with the Board’s recommendations.

Can I use the WHITE proxy card if I want to vote for one or more of the LifeSci nominees?

Yes, if you would like to elect some or all of the LifeSci nominees, we strongly recommend you use the Company’s WHITE proxy card to do so.

Who is entitledWhat happens if LifeSci withdraws or abandons its solicitation or fails to vote atcomply with the Special Meeting?New Proxy Rules and I already granted proxy authority in favor of LifeSci?

HoldersStockholders are encouraged to submit their votes on the WHITE proxy card. If LifeSci withdraws or abandons its solicitation or fails to comply with the universal proxy rules after a stockholder has already granted proxy authority, stockholders can still sign and date a later submitted WHITE proxy card.

If LifeSci withdraws or abandons its solicitation or fails to comply with the universal proxy rules, any votes cast in favor of recordLifeSci nominees will be disregarded and not be counted, whether such vote is provided on the Company’s WHITE proxy card or the LifeSci proxy card.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies on behalf of the Company. In addition to these proxy materials, our common stockdirectors and our Series C Preferred Stockemployees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks, and other agents for the reasonable cost of forwarding proxy materials to beneficial owners.

LifeSci will bear the entire cost of any proxies that they solicit. In its nomination letter, LifeSci indicated that, in the event any of its nominees are elected or appointed to the Board at the closeAnnual Meeting, LifeSci intends to seek reimbursement from the Company of business on March [•], 2022 (the “Record Date”) will be entitledall expenses it incurs in connection with its solicitation of proxies for election of its nominees to notice of, and to vote as a single classthe Board at the Special Meeting and any adjournment thereof.Annual Meeting.

How willmany shares ofmust be present to hold the Series C Preferred Stock be counted for purposes of determining theAnnual Meeting?

The presence of a quorum at the Special Meeting?

For purposes of determining the presence of a quorum at the SpecialAnnual Meeting, shares of our Series C Preferred Stock will be counted with shares of our common stock as a single class on an “as converted” basis. That means that each share of Series C Preferred Stock present will be counted for quorum purposes as the number of shares of common stock into which that such share of Series C Preferred Stock is convertible as of the Record Date. As of the Record Date, each share of Series C Preferred Stock is convertible into one share of our common stock.

How will the presence of a quorum at the Special Meeting be determined?

As previously disclosed in our Current Report on Form 8-K filed with the SEC on March 18, 2022, effective March 18, 2022, the Board approved an amendment to our bylaws, as amended (the “Bylaws”), providing that the presence, in personvirtually or by proxy, duly authorized, of the holders of 33.4% of the outstanding shares of stock entitled to vote shall constitute a quorum for the transaction of business at any meeting of our stockholders (the “Bylaw Amendment”). The Board based its decision to amend the bylaws on our quorum requirement on, among other things, the increasing prevalence of brokerage firms opting to forego discretionary or proportionate voting of the shares held by them in street name, which is making it increasingly difficult for companies with a large retail stockholder base to obtain a quorum of the majority. For additional information, see “Proposal 1 – Reasons for the Reverse Stock Split, Our Prior Solicitation of Proxies, and Our Series C Preferred Stock – Our Prior Solicitation of Proxies and Reflecting the Will of Our Stockholders Amidst Evolutions in Financial Markets and the Stockholder Franchise.” We believe the change to the quorum requirement for stockholder meetings will improve the Company’s ability to hold stockholder meetings when called and transact necessary business without unnecessary cost and delay, while also maintaining a quorum level high enough to ensure that a broad range of our stockholders are represented at the meeting.

Accordingly, the presence at the Special Meeting, virtually or by proxy, of the holders of at least 33.4% of the shares entitled to vote at the Special Meetingcommon stock as of the Record Date will constitute a quorum for the transaction of business at the Special Meeting, provided thatAnnual Meeting. In general, shares of our Series C Preferred Stock will be counted on an “as converted” basis for such purpose. Accordingly, the presence at the Special Meeting of holders of at least [•] shares will be required to achieve a quorum.

In general, sharescommon stock represented by a properly signed and returned proxy card will be counted as shares present and entitled to vote at the SpecialAnnual Meeting for purposes of determining a quorum. Shares represented by proxies marked “Abstain” and “broker non-votes” arerepresenting shares held by stockholders who have not received proxy materials from LifeSci, will be counted in determining whether a quorum is present. A “broker non-vote” is a proxy returned by a broker on behalf of its beneficial owner customer that is not voted on a particular matter because voting instructions have not been received by the broker from the customer, and the broker does not have discretionary authority to vote on behalf of such customer on such matter. If there is not a quorum, a majority of the votesshares of our common stock present at the SpecialAnnual Meeting (including votes represented by proxy) may adjourn the SpecialAnnual Meeting to a later date.

What is “mirrored voting” and how will votes cast by holders of the Series C Preferred Stock be counted for purposes of determining whether each proposal has been approved?

If a quorum is present, holders of our Series C Preferred Stock will vote with holders of our common stock on both proposals at the Special Meeting as a single class on a “mirrored” basis. For every share of Series C Preferred Stock held, the holder will be entitled to 80,000 votes. However, the holders of our Series C Preferred Stock are (i) only permitted to vote on proposals related to the Reverse Stock Split and (ii) are required to cast their votes “For” and “Against” each such proposal in the same proportions as the holders of our common stock eligible and voting at the Special Meeting cast their votes, in the aggregate. For example, if a holder of Series C Preferred Stock is entitled to cast 80,000 votes on a proposal, and the holders of our common stock eligible and voting cast their ballots 90% “For” the proposal and 10% “Against,” the Series C Preferred Stockholder’s 80,000 votes are required to be cast 72,000 votes “For” and 8,000 votes “Against.”

How many total votes are entitled to be cast at the Special Meeting?

As of the Record Date, there were:

|

|

|

|

Accordingly, assuming a quorum is present, the aggregate number of votes entitled to be cast at the Special Meeting is [901,924,581].

How may shares of common stock be voted?

If you return your signed proxy card or use Internet or telephone voting before the Special Meeting, the named proxies will vote your shares as you direct.

For both Proposal 1 – Approval of the Reverse Stock Split and Proposal 2 – Approval of Adjournment of the Special Meeting, you may:

|

| |

|

| |

|

|

If you send in your proxy card or use Internet or telephone voting, but you do not specify how you want to vote your shares, the proxies will vote your shares in accordance with the Board’s recommendations.

How does the Board recommend that I vote my shares of common stock?

The Board recommends that you vote:

|

|

|

|

What vote is required for each proposal to be approved?

Assuming a quorum is present at the SpecialAnnual Meeting, the following table summarizes the vote threshold required for approval of each proposal and the effect on the outcome of the vote of abstentions and uninstructed shares by brokers (referred to as broker non-votes).

Proposal | Item | Vote Required for | Effect of | Effect of Broker |

1 |

|

|

|

|

|

|

| No effect |

|

2 | Ratification of Selection of Independent Registered Public Accounting Firm | Majority of shares present virtually or represented by | Counted “against” | Not voted/No effect |

3 | Advisory Vote on Executive Compensation | Majority of shares present virtually or represented by proxy and entitled to vote | Counted “against” | Not voted/No effect |

Additional Information Regarding Proposal 1 Voting

LifeSci has notified Diffusion of its intent to nominate a slate of six alternative nominees for election as directors at the Annual Meeting in opposition to the six nominees recommended by your Board. As a result, assuming such nominees are in fact proposed for election at the Annual Meeting and such nominations have not been timely withdrawn by LifeSci, the election of directors at the Annual Meeting will be considered a contested election and, as provided under Section 2.8 of our Bylaws, directors will be elected on a plurality basis. Under the plurality voting standard, you may vote “FOR” or “WITHHOLD” authority to vote for up to six nominees, and the six nominees receiving the greatest number of votes cast “FOR” their election among all stockholders will be elected, regardless of whether they were nominated by your Board or by LifeSci. Votes to “WITHHOLD” or “ABSTAIN” with respect to any nominee are not votes cast and will result in the applicable nominee(s) receiving fewer votes cast “FOR” such nominee(s).

HowIt will NOT help elect the nominees recommended by your Board if you sign and return blue proxy cards sent by LifeSci even if you vote to “WITHHOLD” or “ABSTAIN” with respect to LifeSci directors. In fact, doing so will cancel any previous vote you cast on a WHITE proxy card sent to you by Diffusion. The only way to support your Board’s nominees is to vote “FOR” all of your Board’s nominees, which registered stockholders can do I vote my shares?by marking the “FOR ALL” box on the WHITE proxy card. ONLY THE LATEST-DATED, VALIDLY EXECUTED PROXY RECEIVED WILL BE COUNTED.

Your voteAdditional Information Regarding Voting on Proposals 2 and 3

Typically, the ratification of the independent registered public accounting firm is important. Whether you hold shares directlya routine matter as a stockholder of record or beneficially in “street name” (throughto which, under applicable NYSE rules (which NYSE-registered brokers must comply with even with respect to Nasdaq-listed companies), a broker bank,will have discretionary authority to vote if instructions are not received from the client at least 10 days prior to the Annual Meeting (so-called “broker non-votes”). However, because LifeSci has initiated a proxy contest, to the extent that LifeSci provides a proxy card or other nominee),voting instruction form to stockholders who hold their shares in “street” name, brokers will not have discretionary voting authority to vote on any of the proposals at the Annual Meeting. As a result, assuming LifeSci has provided you maywith its proxy materials, all proposals disclosed in this proxy statement, including Proposal 2 for the ratification of the selection of the Company’s independent registered public accounting firm, will be considered non-routine under the rules of the NYSE and your broker will not vote your shares on any proposal without attending the Special Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions toyour instructions.

Accordingly, it is very important that you instruct your broker or nominee.how you wish your shares to be voted on these matters.

“Street Name” Holders (e.g., your shares are in a traditional brokerage account)Who will count the votes at the Annual Meeting?

We currently expect that First Coast Results, Inc. will tabulate the votes and be our independent inspector of elections for the Annual Meeting.

Whom do I contact if I have questions regarding the Annual Meeting?

If you holdhave any questions regarding this information or the proxy materials, please contact Innisfree M&A Incorporated, Inc., our proxy solicitor. Stockholders in the U.S. and Canada may call toll-free at (877) 456-3402. Banks and brokers may call collect at (212) 750-5833.

Are there any matters to be voted on at the Annual Meeting that are not included in this Proxy Statement?

We currently are not aware of any business to be acted upon at the Annual Meeting other than that described in this Proxy Statement. If, however, other matters are properly brought before the Annual Meeting, or any adjournment or postponement of the Annual Meeting, your shares in street name, you should followproxy includes discretionary authority on the instructions provided by your bank, broker, or other nomineepart of the individuals appointed to vote your shares beforeor act on those matters according to their best judgment, including to adjourn the Special Meeting. You can also vote at the SpecialAnnual Meeting if you register for the meeting following the instructions above under “How do I attend the Special Meeting?”.

Registered Holders (e.g., you have a Diffusion stock certificate or shares in an account with our transfer agent, Computershare)quorum is not present.

If you are a stockholder whose shares are registered in your name, you may vote your shares by one of the following methods:

|

|

|

|

|

|

|

|

The telephone and internet voting facilities will close at 11:59 p.m. ET on April [•], 2022. If you are a registered holder voting by one of those methods, please cast your votes before that time.

Under the rules of the New York Stock Exchange that govern how brokers may vote shares for which they have not received voting instructions from the beneficial owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. These New York Stock Exchange rules apply to brokers even when the securities at issue are traded on Nasdaq.

Both Proposal 1 regarding the Reverse Stock Split and Proposal 2 regarding adjournment are considered “routine” matters. Therefore, if you do not provide voting instructions to your broker regarding either proposal, your broker will be permitted to exercise discretionary voting authority to vote your shares on your behalf.

How can I revoke or change my vote if I am a holder of common stock?

If you are a stockholder whose shares are registered in your name, you may revoke your proxy at any time before it is voted by one of the following methods:

|

| |

|

| |

|

|

If you hold your shares through a broker, bank or other nominee, you may revoke your proxy by following instructions your broker, bank or other nominee provides.

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies.

We have engaged Alliance Advisors, LLC to assist in the solicitation of proxies and provide related advice and information support, for a services fee and the reimbursement of customary disbursements, which are not expected to exceed $160,000 in total.

In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks, and other agents for the reasonable cost of forwarding proxy materials to beneficial owners.

Who will count the votes at the Special Meeting?

We currently expect that our [•] will be our inspector of elections for the Special Meeting.

Whom do I contact if I have questions regarding the Special Meeting?

If you have questions about the Special Meeting or would like additional copies of this Proxy Statement, you should contact us via e-mail at proxyrequests@diffusionpharma.com.

How will business be conducted at the SpecialAnnual Meeting?

The presiding officer at the SpecialAnnual Meeting will determine how business at the meeting will be conducted. Only nominations and other proposals brought before the Annual Meeting in accordance with the advance notice and information requirements of our Bylaws will be considered. No such nominations or other proposals were received other than the nominations from LifeSci, and no other nominations for election to our Board may be made by stockholders at the Annual Meeting. In order for a stockholder proposal to have been included in our Proxy Statement for the Annual Meeting, our General Counsel & Corporate Secretary must have received such proposal a reasonable period of time before we began to print and send our proxy materials. Under our Bylaws, because the date of the Annual Meeting is delayed by more than thirty (30) days after the anniversary of the 2021 Annual Meeting of Stockholders, in order to be included in this Proxy Statement, complete and timely written notice of a proposed nominee for election to the Board at the Annual Meeting or a proposal for any other business to be brought before the Annual Meeting must have been received by our General Counsel & Corporate Secretary not later than the close of business on the tenth day following the day on which public announcement of the date of the Annual Meeting is first made.

APPROVALBACKGROUND OF A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY A RATIO OF ANY WHOLE NUMBER BETWEEN 1-FOR-2 AND 1-FOR-50, AT ANY TIME PRIOR TO DECEMBER 31, 2022, THE IMPLEMENTATION AND TIMING OF WHICH SHALL BE SUBJECT TO THE DISCRETION OF THE BOARD

Summary of Reverse Stock Split Proposal

Our Board of Directors (the “Board”) has unanimously approved, and unanimously recommends that our stockholders approve, an amendment to our Charter (the “Certificate of Amendment”), to effect the reclassification and combination of all shares of common stock outstanding at a ratio of not less than one-for-two and not greater than one-for-50 (the “Reverse Stock Split”), with the final decision of whether to proceed with the Reverse Stock Split, the effective time of the Reverse Stock Split, and the exact ratio of the Reverse Stock Split (the “Split Ratio”) to be determined by the Board, in its discretion, at any time prior to December 31, 2022.SOLICITATION

As describedreported in more detail below, the Board believes that the Reverse Stock Split is desirable and in the best interests of Diffusion and our stockholders for many reasons, including regaining compliance with the listing requirementsDiffusion’s 2021 Annual Report, one of the Nasdaq Capital Market, maintaining increased accesskey objectives underlying the Company’s business strategy for 2022 involved identifying and pursuing opportunistic transactional opportunities intended to capital markets that we believe will be required to continue fundingdiversify the developmentCompany’s portfolio of our product candidates and improvingreduce the Company’s overall perception of our common stockrisk profile as an investment security, particularly long-term investors that support and have interest in our product development plans.

If our stockholders approve the Reverse Stock Split, and the Board decides to implement it, the Reverse Stock Split will become effective as of 12:01 a.m., Eastern Time on a date to be determined by the Board and specified in the Certificate of Amendment. However, if the Board does not implement the Reverse Stock Split prior to December 31, 2022, the authority to implement the Reverse Stock Split granted by stockholders’ approvalinvestment. In pursuit of this proposal will terminate.

Ifobjective, from time to time during the Board decides to implementfourth quarter of 2021 and first half of 2022, Diffusion’s management team entered into customary nondisclosure agreements and held conversations with several potential counterparties with the Reverse Stock Split, it will be realized simultaneouslyintent of identifying assets and uniformly by all shares and all holders of outstanding common stock immediately prior to the effective time determined by the Board. Immediately following the Reverse Stock Split, each stockholder will hold the same percentage of common stock outstanding ascommercial opportunities that stockholder held immediately prior to the Reverse Stock Split, subject to minor adjustments that may result from the treatment of fractional shares described below. In other words, the Reverse Stock Split will have no material impact on the total percentage of common stock that you own. The Reverse Stock Split will not change the parwould enhance long-term value of our common stock or the number of authorized shares of common stock under our Charter. However, the exercise price and number of shares of common stock underlying warrants, options, restricted stock units, shares of preferred stock, and any other securities exercisable for or convertible into common stock will be adjusted proportionally as of the effective time based on the Split Ratio in accordance with their respective terms.

In addition, if our stockholders approve the Reverse Stock Split, we will be entitled to force the holders of our Series C Preferred Stock, and holders of our Series C Preferred Stock will have the option, to convert their shares of preferred stock to shares of our common stock at a conversion price of $0.50 per share of common stock.

Reasons for the Reverse Stock Split, Our Prior Solicitation of Proxies, and Our Series C Preferred Stock

Curing our Nasdaq Listing Deficiency and Maintaining Market Access for Our Company and Our StockholdersDiffusion’s stockholders.

On May 6, 2021, we received10, 2022, the Company’s Board held a written notice frommeeting and authorized management to being the staff (the “Staff”)process of engaging an investment bank to further support the Company’s process.

On May 26, 2022, David Dobkin, in his capacity as a managing director of LifeSci Capital, an investment bank that claims it provides life science companies with independent advisory services and experienced counsel to assist in making fully informed capital markets decisions and an affiliate of LifeSci, sent an unsolicited email to Robert Cobuzzi, Diffusion’s Chief Executive Officer, and Willian Hornung, Diffusion’s Chief Financial Officer, and placed a call to Diffusion purportedly on behalf of an unidentified large stockholder of Diffusion, requesting a call to discuss strategic alternatives. In response to the outreach, William Elder, Diffusion’s General Counsel, contacted Mr. Dobkin that same day. When asked, Mr. Dobkin refused to disclose the identity of the Listing Qualifications Departmentinvestor or the nature of The Nasdaq Stock Market, LLC indicatingthe alternatives. In addition to serving as a managing director for LifeSci Capital, Mr. Dobkin also serves as a portfolio manager for LifeSci.

That next day, Mr. Dobkin emailed Mr. Elder again requesting that wehis client have a direct forum with Diffusion’s management to discuss merging one or several new assets into Diffusion, a restructuring, and/or other strategic alternatives. Mr. Dobkin continued his refusal to identify his client and indicated that he and his client were unwilling to enter into a customary nondisclosure agreement prior to a substantive discussion with Diffusion.

On June 1, 2022, representatives of Tiberend Strategic Communications (“Tiberend”), Diffusion’s investor relations firm, attempted to reach Mr. Dobkin, but he did not return their call.

On July 18, 2022, Diffusion engaged Canaccord Genuity (“Canaccord”) as its financial advisor in complianceconnection with the minimum bid price requirement containedBoard’s expansion of its ongoing evaluation of potential financial and strategic transactions to enhance stockholder value, including with respect to a sale of the Company.

On August 4, 2022, Mr. Dobkin emailed Mr. Elder again requesting a call with management without providing any specific information regarding the identity his purported client(s) or any further details regarding the strategic alternatives he was proposing.

Diffusion did not hear again from Mr. Dobkin or LifeSci for a number of weeks. Then, on September 14, 2022, Mr. Dobkin again emailed Dr. Cobuzzi and Mr. Elder, this time asserting that an unidentified client of LifeSci Capital had amassed a 4.9% stake in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”) becauseDiffusion. In follow-up communications between representatives of Diffusion, Tiberend and Mr. Dobkin over the bid pricenext couple of days, Mr. Dobkin claimed that his client and affiliated companies had assets complementary to Diffusion’s lead product candidate, trans sodium crocetinate, and desired to explore strategic alternatives. Mr. Dobkin continued to press for oura call with management but refused to identity his client(s) or provide any further details regarding any proposed alternatives.

On September 21, 2022, Mr. Elder again offered for Diffusion to enter into a mutual nondisclosure agreement with LifeSci Capital or its client to facilitate a conversation regarding proposed alternatives. On September 26, 2022, Mr. Elder presented Mr. Dobkin with a customary nondisclosure agreement, to which Mr. Dobkin responded that LifeSci Capital and/or its client were unwilling to agree to certain provisions of the proposed non-disclosure agreement but that he would now be willing to share additional information without a nondisclosure agreement.

On September 27, 2022, on a call with Mr. Elder and representatives from Tiberend, Mr. Dobkin identified three purported clients of LifeSci Capital purportedly interested in a transaction with Diffusion, (1) an alleged asset manager for high net-worth individuals that according to Mr. Dobkin held the 4.9% position in Diffusion’s common stock had closed below $1.00 per sharereferred to in his e-mails of May 26, 2022 and September 14, 2022, (2) a private, U.S.-based oncology company (“Company A”), and (3) a private, Latin America-based healthcare company. Mr. Dobkin, however, did not specify the nature of the transaction(s) contemplated or any other proposed details.

On October 16, 2022, Mr. Dobkin sent an unsolicited proposal to Diffusion, purportedly on behalf of Company A for the previous 30 consecutive business days. On November 3, 2021, after failing to regain compliance withpurchase of all outstanding shares of Diffusion common stock for $6.58 per share. The price offered in the Bid Price Rule within 180 days of our receiptproposal represented just over 50% of the first notice, we received an additional notice from the Staff providing that, although the Company had not regained compliance with the Bid Price Rule by the previously stated deadline, in accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company would be granted an additional 180 calendar days, or until May 2,value of Diffusion’s balance of cash, cash equivalents and marketable securities at September 30, 2022 to regain compliance with the Bid Price Rule. To regain compliance, the bid price for the Company’s common stock must close at $1.00of approximately $12.68 per share or more for a minimum of 10 consecutive business days.

We are optimistic and excited about Diffusion’s future and we believe regaining compliance with the Bid Price Rule and maintaining our Nasdaq listing is a critical near-term step to fulfilling our Company’s potential.share.

Delisting Destroys Stockholder ValueOn October 18, 2022, Diffusion’s Board, together with Diffusion’s senior management team and Diffusion’s independent financial and legal advisors, met to discuss, among other things, the unsolicited proposal and the potential for publicly disclosing Diffusion’s strategic review process.

Historical evidence demonstratesOn October 19, 2022, Mr. Dobkin followed up with Diffusion, purportedly on behalf of Company A, regarding the destructionanticipated timing of Diffusion’s response to Company A’s unsolicited offer.

On October 20, 2022, Mr. Elder replied to Mr. Dobkin, stating that Diffusion was evaluating the offer, but expected to have a response soon.

On October 25, 2022, Diffusion issued a press release publicly disclosing its ongoing strategic review process. That same day, a letter was delivered to Mr. Dobkin on behalf of Diffusion’s Board rejecting the proposal from Company A as woefully inadequate and inviting Company A to contact the Company’s investment bankers regarding participation in Diffusion’s ongoing strategic process should Company A desire to submit a more competitive offer. Mr. Dobkin was also provided with the form of nondisclosure agreement provided to other bidders in the process. To date, however, neither Mr. Dobkin nor any other representative of LifeSci Capital, has directly responded to the invitation or provided any comments or feedback on the proposed form of nondisclosure agreement which had been provided to and entered into by other participants in the process.

On November 7, 2022, Mr. Dobkin, in his capacity as a portfolio manager of LifeSci Special Opportunities Master Fund Ltd., submitted a letter to Diffusion seeking to nominate an alternative slate of directors at the Annual Meeting on LifeSci’s own behalf.

According to LifeSci’s nomination letter, entities affiliated with LifeSci began accumulating Diffusion stock on May 2, 2022 and had acquired a 4.8% position as of November 7, 2022. During his communications with Diffusion and its representatives between May 2022 and October 2022 in his capacity as a managing director for LifeSci Capital, despite contemporaneously serving as a portfolio manager for LifeSci, Mr. Dobkin at no point disclosed that the purported 4.9% stockholder valueto which he alluded on multiple occasions had any affiliation with LifeSci Capital other than the alleged investment banking relationship.

On November 9, 2022, Diffusion’s Board, together with Diffusion’s senior management team and Diffusion’s independent financial and legal advisors, held a meeting to discuss, among other things, the strategic review process, the LifeSci nomination letter and the timing of the Annual Meeting. At that typically resultsmeeting, Canaccord noted that a number of companies had expressed potential interest in a transaction with the Company but reported that there had still been no response from LifeSci or Company A with respect to joining the process. In addition, Diffusion’s Board determined to reschedule the date of the Annual Meeting until December 30, 2022 to, among other things, afford the Company more time to devote to progressing the strategic review process in a manner best designed to enhance stockholder value.

On November 10, 2022, Diffusion filed a Current Report on Form 8-K announcing that the date of the Annual Meeting had been rescheduled to December 30, 2022.

On November 14, 2022, Diffusion issued a press release in which it provided an update on its ongoing strategic review process and, among other things, publicly disclosed its receipt and rejection of the unsolicited offer from Company A and its subsequent receipt of the nomination letter from LifeSci.

On November 17, 2022, LifeSci issued a press release announcing its intention to nominate its own slate of nominees to the Company’s Board.

On November 18, 2022, Diffusion filed a preliminary proxy statement on Schedule 14A with the SEC.

On November 22, 2022, LifeSci filed a preliminary proxy statement on Schedule 14A with the SEC.

On November 28, 2022, Diffusion filed this revised preliminary proxy statement on Schedule 14A with the SEC.

CORPORATE GOVERNANCE

Introduction

Our common stock being delistedis currently listed for quotation on the Nasdaq Capital Market under the symbol “DFFN.” As required by the Listing Rules of the Nasdaq Capital Market, the Board has adopted certain governance standards, including its standard of independence.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines, a copy of which can be found on the Investor Relations—Corporate Governance section of our corporate website at www.diffusionpharma.com. Among the topics addressed in our Corporate Governance Guidelines are:

● | Board size, composition and qualifications; | ● | Retirement, term limits, and resignation policy; |

● | Selection of directors; | ● | Board compensation; |

● | Board leadership; | ● | Loans to directors and executive officers; |

● | Board committees; | ● | Chief Executive Officer evaluation; |

● | Board and committee meetings; | ● | Board and committee evaluations; |

● | Executive sessions of outside directors; | ● | Director continuing education; |

● | Meeting attendance by directors and non-directors; | ● | Succession planning; |

● | Appropriate information and access; | ● | Related person transactions; |

● | Ability to retain advisors; | ● | Communication with directors; |

● | Conflicts of interest and director independence; | ● | Director attendance at annual meetings of stockholders; and |